**Deterioration of Capital One to Emirates Transfer Ratio**

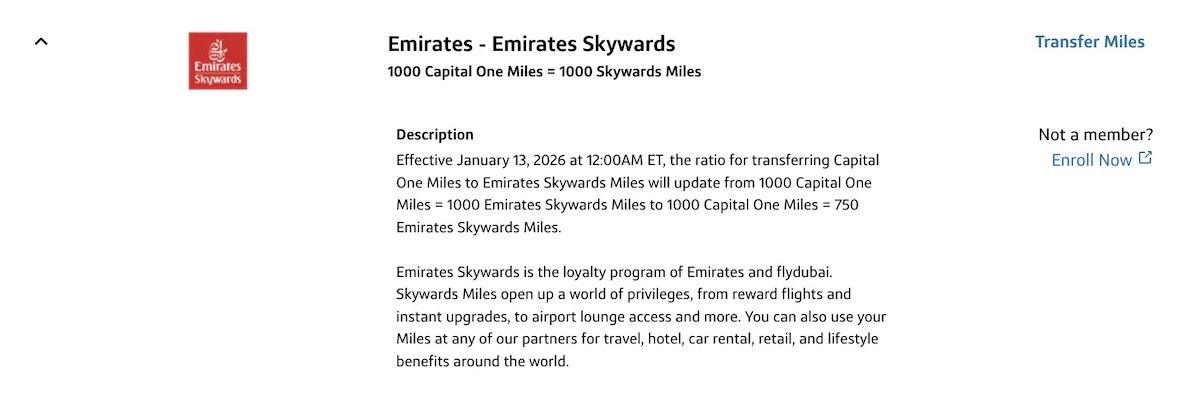

The Capital One miles program features roughly 20 airline and hotel transfer affiliates, with the majority of transfers executed at a 1:1 ratio. Nevertheless, a devaluation is anticipated for one of its partners. Commencing January 13, 2026, the transfer ratio for Emirates Skywards will be adjusted to a 4:3 ratio (or 1,000:750). Consequently, Capital One becomes the fourth significant transferable points currency to modify its Emirates Skywards transfers, trailing Citi ThankYou, Amex Membership Rewards, and Chase Ultimate Rewards.

In the instances of Amex and Citi, the transfer ratio was reduced to 5:4, rendering the 4:3 transfer ratio from Capital One the least advantageous, besides Chase, which has completely eliminated Emirates as a partner.

**What’s Causing This Emirates Points Devaluation?**

When transferring points to an airline or hotel currency, funds are exchanged, with differing reimbursement rates between partners. Emirates Skywards transfers have encountered devaluation across partners, likely due to Emirates being a higher-cost transfer partner. This indicates Emirates is requiring more funding from its partners, affecting consumers.

Emirates seems to be capitalizing on its premium cabins more efficiently, evident with elevated award costs and surcharges. Recently, Emirates limited first-class awards to those holding Skywards elite status. Unlike U.S. airlines, which frequently conduct loyalty programs as loss leaders, Emirates is committed to enhancing loyalty through its Skywards initiative.

**Final Thoughts**

Starting January 2026, Capital One will diminish its Emirates Skywards transfer ratio to 4:3. This follows analogous devaluations from Amex Membership Rewards and Citi ThankYou, while Chase Ultimate Rewards has severed connections with Emirates. Emirates appears to be adopting a new approach with its points currency, aiming for increased revenue.